Like last year, in 2023 we bring you key findings from the research, where we mapped the level of CX maturity in Slovak organizations. Which industries are performing the best, and which ones, on the other hand, are lagging behind?

In the 19th episode of the Minimum Viable Podcast, Michal Blažej discusses a comprehensive view of CX in the Slovak market with Juraj Blichár, the Head of Production at Lighting Beetle*. Find out how the level of CX Maturity changed over the past year, what are the factors behind it, and what challenges are ahead of companies in the near future.

Minimum Viable Podcast is brought to you by the CX design studio Lighting Beetle*. It's usually recorded in the Slovak language, however, you can read an English transcription of this episode below. For more content in English, including case studies and handouts, visit our Journal.

You can find the Minimum Viable Podcast on:

- Spotify

- Apple Podcasts

- Google Podcasts

- Anchor

- Castbox

- or below in full transcription.

Today's Minimum Viable Podcast will be special for two reasons. The first one is that we recorded it on video because we want to show you the results of the Customer Experience Study we conducted last year in cooperation with the Slovak User Experience Association (SUXA). Within it, we focused on the CX maturity of Sloak organizations and we believe it's good to provide you with some graphs and visual material on this matter.

The second reason is that we invited a guest from the internal environment today - Juraj Blichár, who is our Production Director. Together we would like to discuss his experiences with CX transformation. He will provide us with practical insight as he visits our clients and perceives how companies are changing.

We conducted a similar survey last year - with approximately 40 respondents. This year was a bit more successful. We received 130 responses. Our motivation was primarily the fact that every time we helped clients on their journey to become more customer-oriented, we didn't have enough information. We often helped companies connect with their competition.

Clients usually asked, "How do we compare to other clients?" And we never had such quantitative data that interested us. We were guided by feelings based on experience, and what we went through.

This "snooping" was our motivation to complement qualitative data with quantitative ones. Thanks to the Slovak User Experience Association (SUXA), we managed to collect 130 responses from companies of various sizes. Mostly, these were relatively large companies.

Up to 80% of the responding companies had more than 100 employees, and 20% were companies with 2000 or more employees, so we can say it was quite relevant. Why did larger companies respond to the survey?

In my opinion, the reason is that CX is gaining importance. On one hand, we collaborated with SUXA, which allowed us to have a greater impact. The results also prove it. In addition, compared to last year, CX has a greater impact on organizations. They are starting to understand this topic and see its value.

Especially smaller organizations may not need to have CX specialists.

They already had specialists for a longer time because they don't have so highly specialized tasks, and therefore, the implementation of CX takes less time for them.

We also measured the ratio of represented positions in our survey. Approximately one-third of the responses came from leaders and department managers. About one-third came from product designers, and 20 percent were product managers, so a very nice representation. The largest industries we covered in the study were Software solutions at 30%, Financial services at 20%, followed by Telecommunications and High-tech at 7%.

As part of the research, we were primarily interested in the level of Customer Experience maturity of these organizations, rather than customers satisfaction itself.

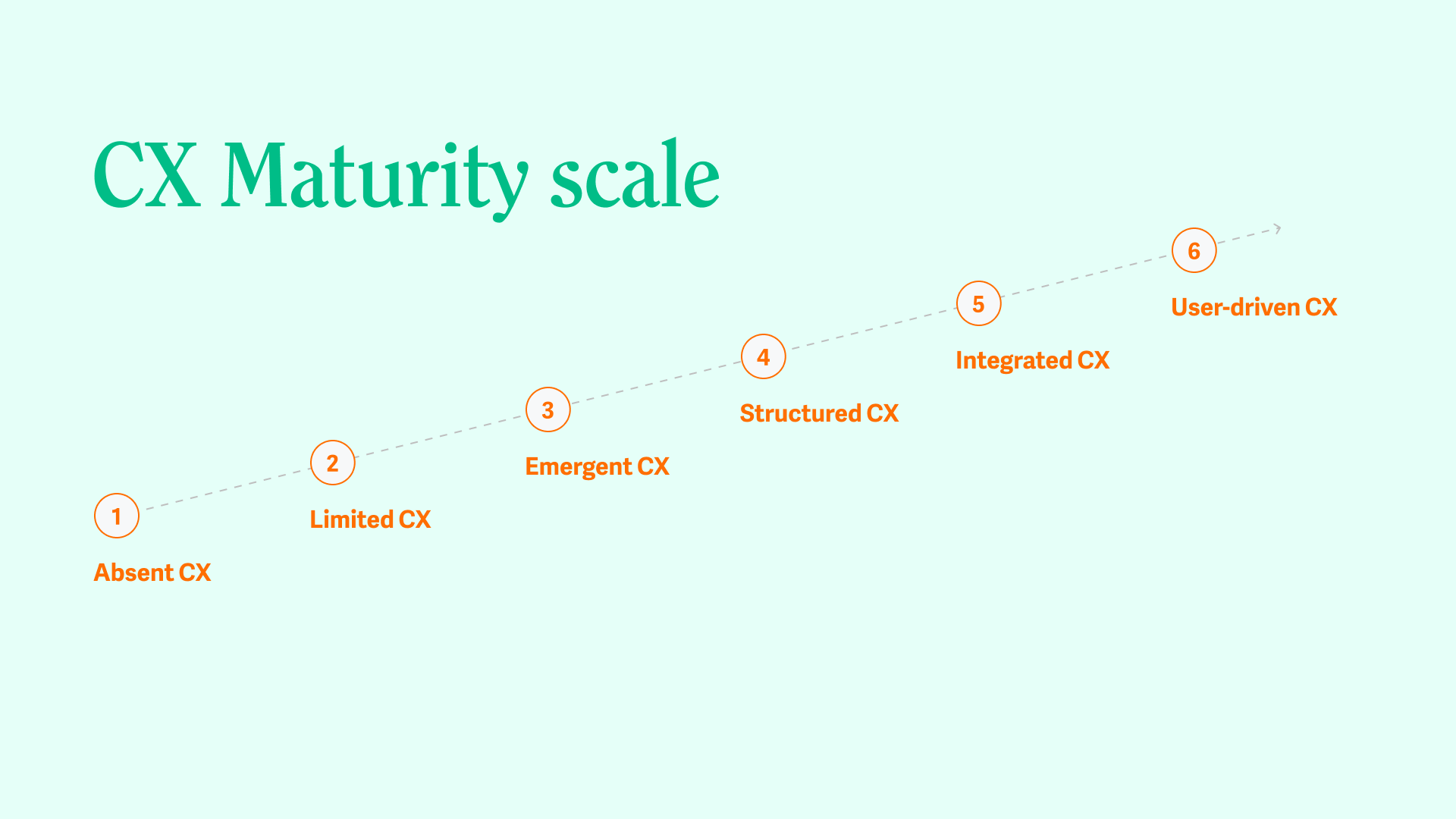

To be in line with the global benchmark, we use the most up-to-date scale from the Nielsen Norman Group, which divides companies into 6 levels based on their CX maturity. Level 1, Absent CX, means a complete lack of CX, while level 6 represents fully User-driven CX.

So, Level 1 is Absent CX.

Yes. Level 2 is Limited CX, which it is mainly about individual effort. People who want to try doing things differently know that the world approaches it differently and they try it in their teams. Gradually, they start gaining allies.

Level 3 is Emergent CX, where we move from individuals to a team that sees the importance of meeting with the customer and their involvement in the process. However, even at this level, CX still does not have a budget, as management perceives it more as a matter of aesthetics - let's have prettier applications, let's have prettier solutions.

Next is Level 4, Structured CX. Here, the company realizes the importance and value of Customer Experience and even measures it. At this point, it's no longer a matter of individual or one team effort, but the design processes are already established within the company.

The biggest challenge that comes at this level is proving the value of CX. The company has more people, more specializations are emerging, and their question is whether it's worth it.

Then comes Level 5, Integrated CX.

Yes. At this level, CX is very important for companies; top management often brings up this topic, and it is one of the strategic areas. However, unlike Level 6 - the rhythm of the company is still dictated by business goals.

At the highest level, which is called User-driven CX, everything is primarily set accordingly to the customer needs, with business needs being secondary.

Our goal, therefore, was to find out where Slovak companies stand within the 6-level scale. In addition to categorizing companies according to their CX maturity level, we also examined the pillars or factors of customer experience, which are also six. The first pillar is the budget.

For those companies with Absent CX, the budget is zero. At slightly higher levels, companies realize the value of customer experience only through visuals or aesthetics. Companies typically buy packages from suppliers or simply hire their graphic designer, and the budget is automatically considered. They plan on an annual basis. This creates pressure and questions the return of the investment.

The second factor we looked at was the company's strategy. We investigated whether the company has CX in its strategy.

There are two dimensions. The first dimension is how they work with the customer and their needs. Whether their annual strategy and goals consider this aspect. Based on that, they propose solutions, work with them and scale them.

But there is also a second dimension, which is how they approach building and growth. It's not just about knowing what the customer wants and, for example, introducing the requested product to the market accordingly. It's also about how they can grow within the scale that we, for instance, in cooperation propose.

Another pillar of CX is quality. Here, we move on a scale from the point where companies do design only to have nice products, to the point where they start to measure quality or bring innovations. It's a qualitative aspect.

The involvement of departments is another factor or pillar of CX that we examined. Here, we mainly considered how many different people are involved. Whether it's only individuals, whether CX specialists are even invited to the projects, up to the point of various multidisciplinary teams’ existence and their mutual collaboration.

Yes. The higher the level, the more importance this factor gained, and the involvement of various people became greater.

And the last two pillars were awareness and embedding, which are quite similar in essence. The first one focuses on the individual, while the second one is about the overall understanding of how important the customer in that organization is. It progresses from an aesthetic tool to the point where top management adopts customer experience practices. That's about the survey from the theoretical perspective, and now let's talk about the results.

Slovakia is at a CX maturity level of 3.5, between "Emergent" and "Structured" CX. How do you evaluate it? How far have we come since last year?

Compared to the last year, it's much better, which is confirmed also by the data. It's also significant that our sample was much bigger this year. It's evident that Customer Experience or CX is gaining recognition. It has even extended to sales. CX was earlier a better-known term in marketing, but it is now being addressed in other departments as well. CX is no longer just a matter for designers and marketers. We were wondering why there was such an improvement.

Last year, we thought we would catch up with the global standard in 2 years, but we managed to do it in 1 year, which is fantastic. Within organizations, you often hear about Customer Experience. This is an important finding. NN Group publishes results annually. They have not yet published their 2022 survey, which makes it challenging for us to evaluate across the entire market.

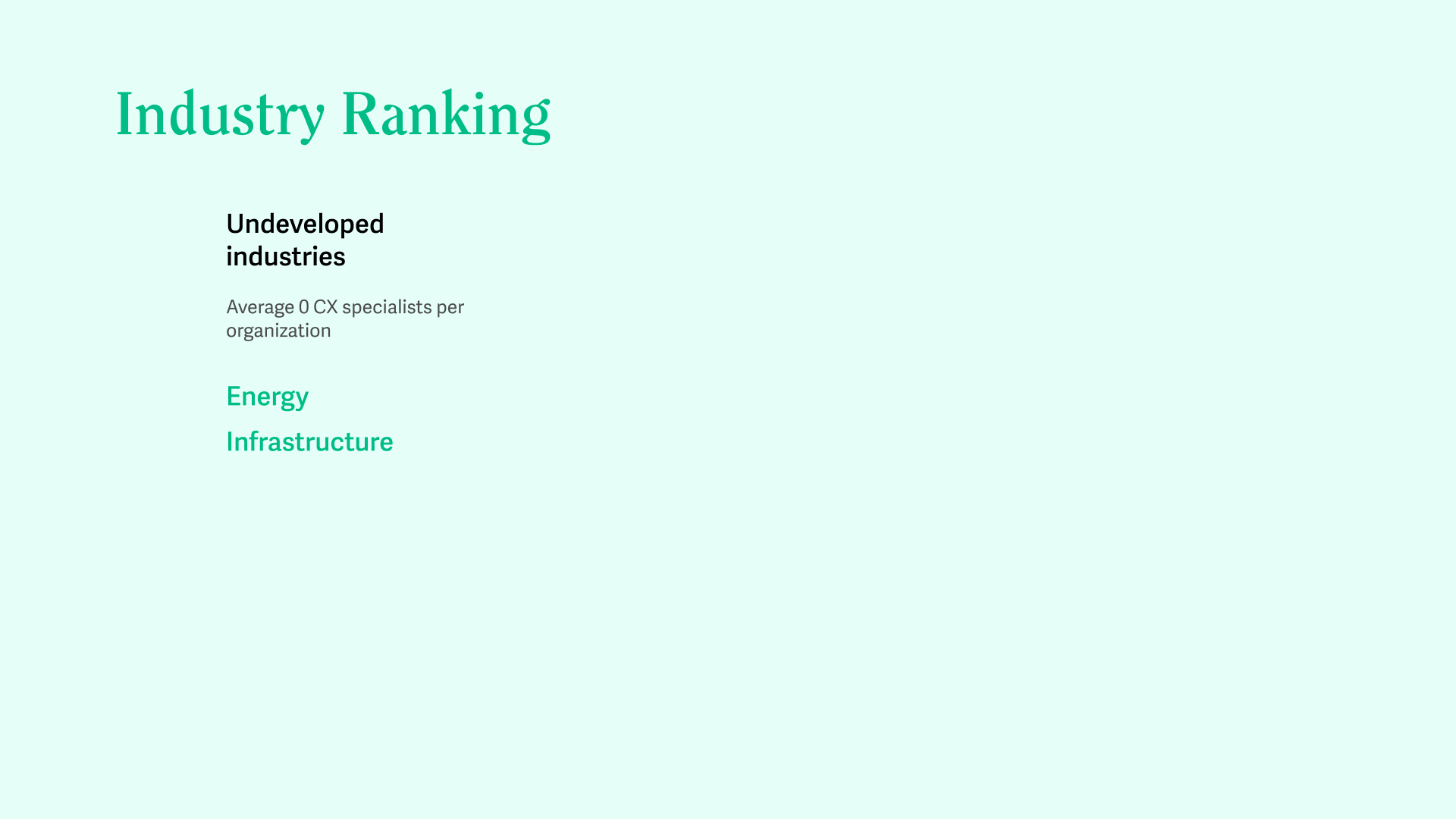

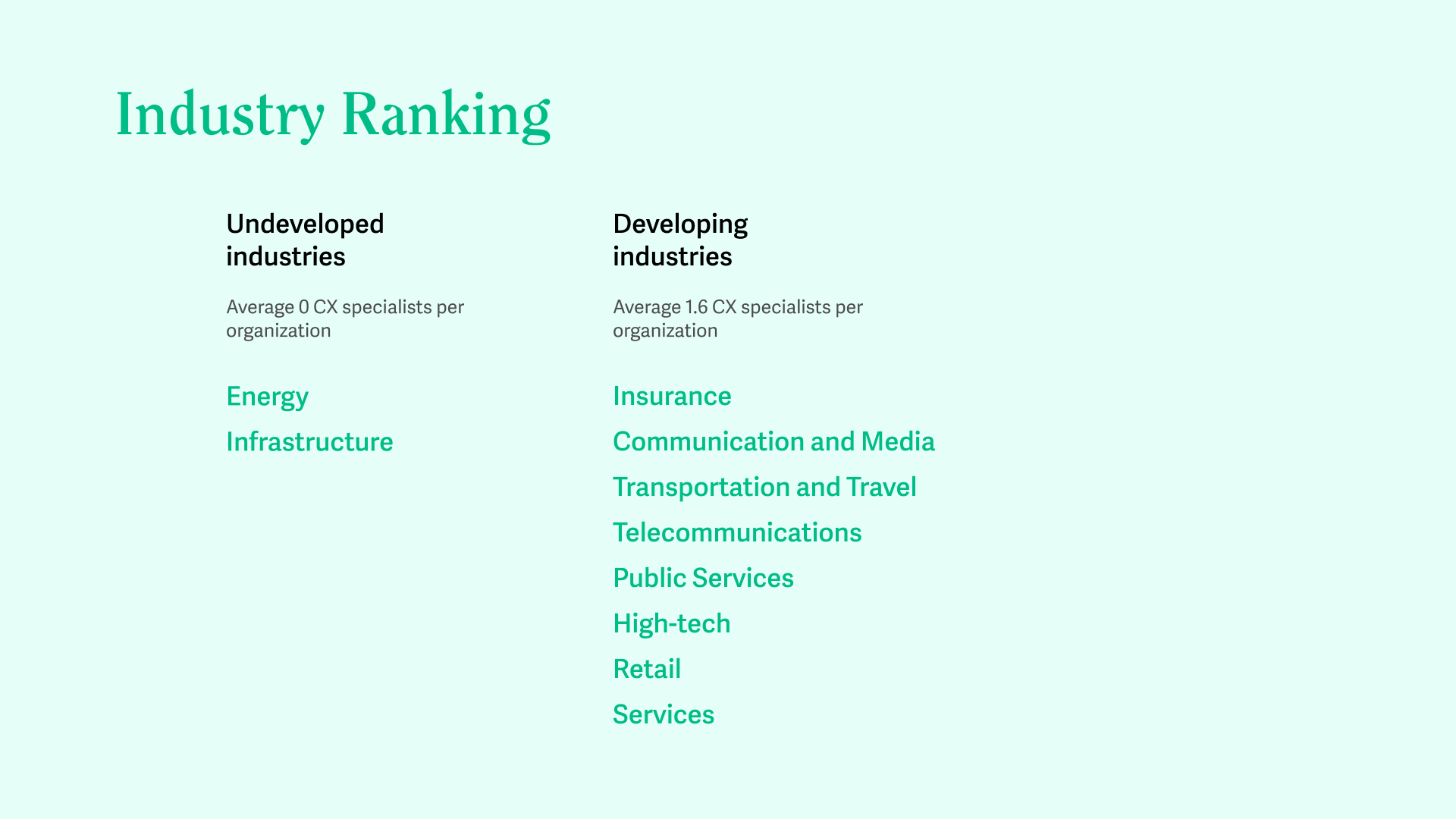

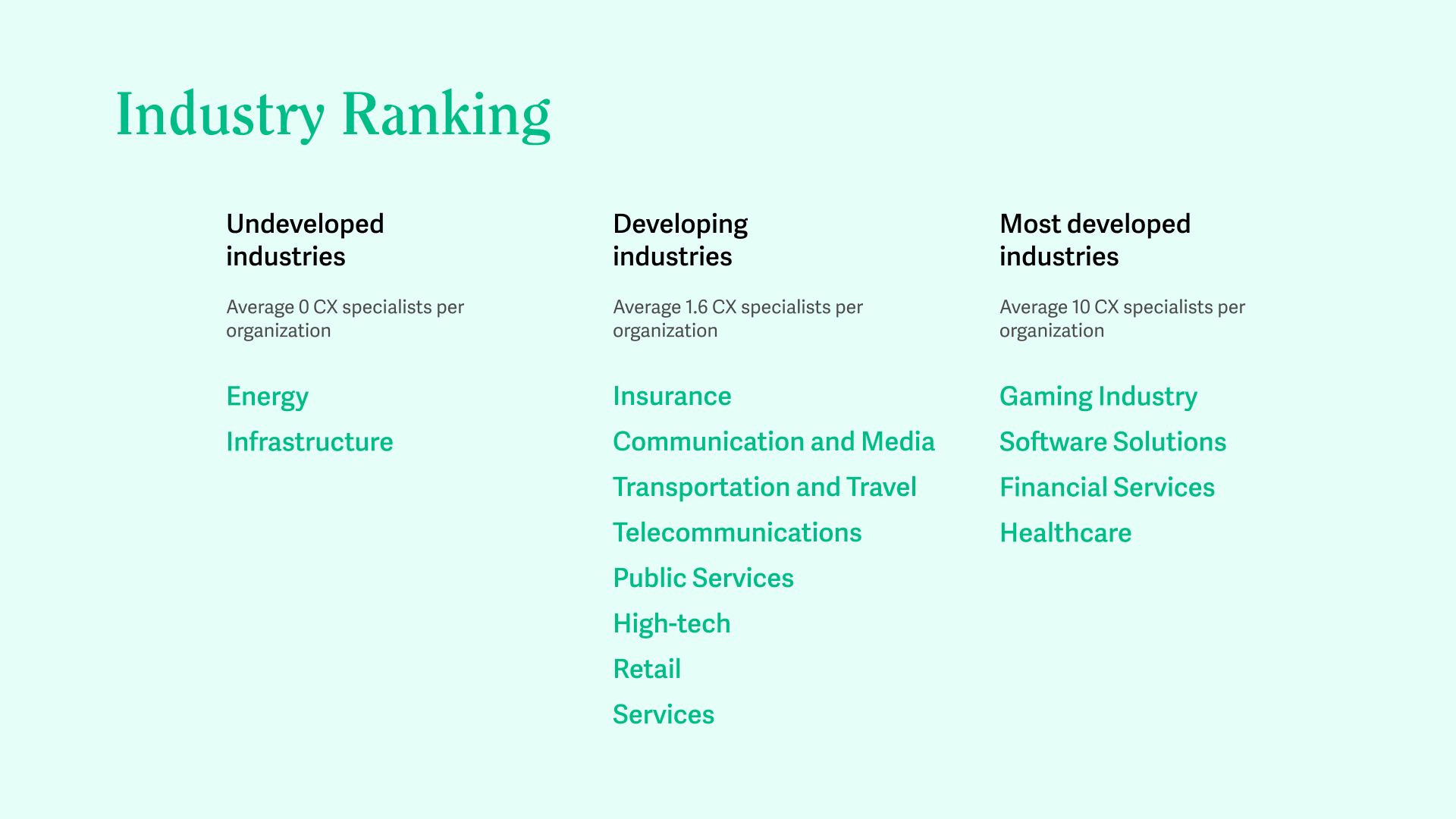

Let's take a closer look at individual industries. I think it's an interesting view of how we have progressed. From the survey, it seems that the most lagging industries are Energy and Infrastructure. On average, they employ 0 CX specialists per organization. Why are they doing so poorly?

Typically, it's a commodity segment, so it's lagging behind. For example, people take gas for their entire life and don't need to focus that much on the Customer Experience.

The developing industries are Insurance, Services, Communication and Media, Transportation and Travel, Telecommunications, Public Service, High-tech, and Retail. On average, they have 1.6 specialists per organization. Why is Telecommunications (Telco) a leader in innovation?

It was quite surprising for me as well. In the past, they led in growth, digitalization, and access to modern technologies. It was surprising that they are not the most developed. The market in Slovakia is quite saturated. They operate in something that is already established. The only thing they need to do is minimize operational costs. Calls are often unlimited and free. Essentially, they only offer mobile data, and that differentiates them. Therefore, it's crucial for them to minimize operational costs.

Again, a very similar commodity problem as in Energy and Infrastructure. Despite that, they have a significant customer-facing aspect. Many touchpoints involve customers.

They have branches where they work with Customer Experience. They have call centers and many advertisement, and still, it's not good. It's surprising.

Public Services have moved forward. They are heading towards developing industries.

And that's great. We didn't find Public Administration in underdeveloped industries, where there are 0 CX specialists. Even when we work with the government, you can see that there is interest. They realize that the importance of citizens is essential throughout the process. Not only because they digitized, but also because they have fewer phone calls, fewer complaints, fewer negative comments on social media, and so on. They are motivated.

I must emphasize the Social Insurance Company. I consider it one of the most customer-facing organizations toward citizens. They have very kind people there. The website is revamped, they have design manuals, questions, answers, and straightforward processing. The Public sector is moving forward in this aspect.

Now, the most advanced industries. It's Gaming, Software solutions, Financial Services, and Healthcare. And now comes the leap. In the developing industries, it's 1.6 specialists per organization, while in the most advanced, it's 10 CX specialists per organization. Why does Gaming fall into this category?

Gaming is not a surprise. It has always been about the experience. This just gives them a new way to approach it and new methods to better target it. It's a given that they adapted quickly. This industry has always been about design.

The Game mechanics is probably guided by what customers want.

Yes, but also by how the game is set up and the experience it creates. There, we can beautifully measure the curve. They adapted very quickly.

And what about Software Solutions?

There we focused on two areas. Software solutions as companies that create products and sell them on the market, and then Software solutions as companies that provide services for the development of information services. Regarding the product-based ones, there is a relatively strong competitive environment, mainly because of the Startup sector. Even when organizations are larger, they don't know when someone will surpass them.

Startups quickly learned how to find a place in the market by reflecting on needs. It can very easily happen that something that was established suddenly shifts elsewhere. As a result, they are motivated within the competitive environment. For Software Solutions providers, a new opportunity arises in the market, for which there is demand.

In Financial Services, there are banks and also providers of other financial services like ČSOB, SLSP, and Tatrabanka, who have huge UX teams.

Everyone is involved, and quite active. Therefore, Telco is a surprise for me. There are similar touchpoints in similar styles, but in banks, it's more about the relationship. When I give someone my money to take care of, it's perceived more sensitively, so the motivation to focus on the experience is more interesting for them since it can differentiate them from the competition in this aspect.

In my opinion, Telco also has had a long-term problem with the question of what services it should provide. They primarily offer infrastructure, but the banks provide various loans and other products, which helps with the entire experience. There's always something to design, and there's always a new challenge.

Then we had healthcare. Why is healthcare investing in CX?

In the context of Slovakia, it's because of the competitive environment. People don't have much choice. Each insurance company offers almost the same because it's legislatively regulated. Therefore, the only thing left for them is to differentiate themselves slightly in terms of the products they offer and how convenient their service is.

On the other hand, it's advantageous for them. Since legislation also restricts expenses and operational costs, customer service is often oriented towards self-service. As a result, operational costs are reduced, and the space for innovation is maximized. Or they can convert it into profit.

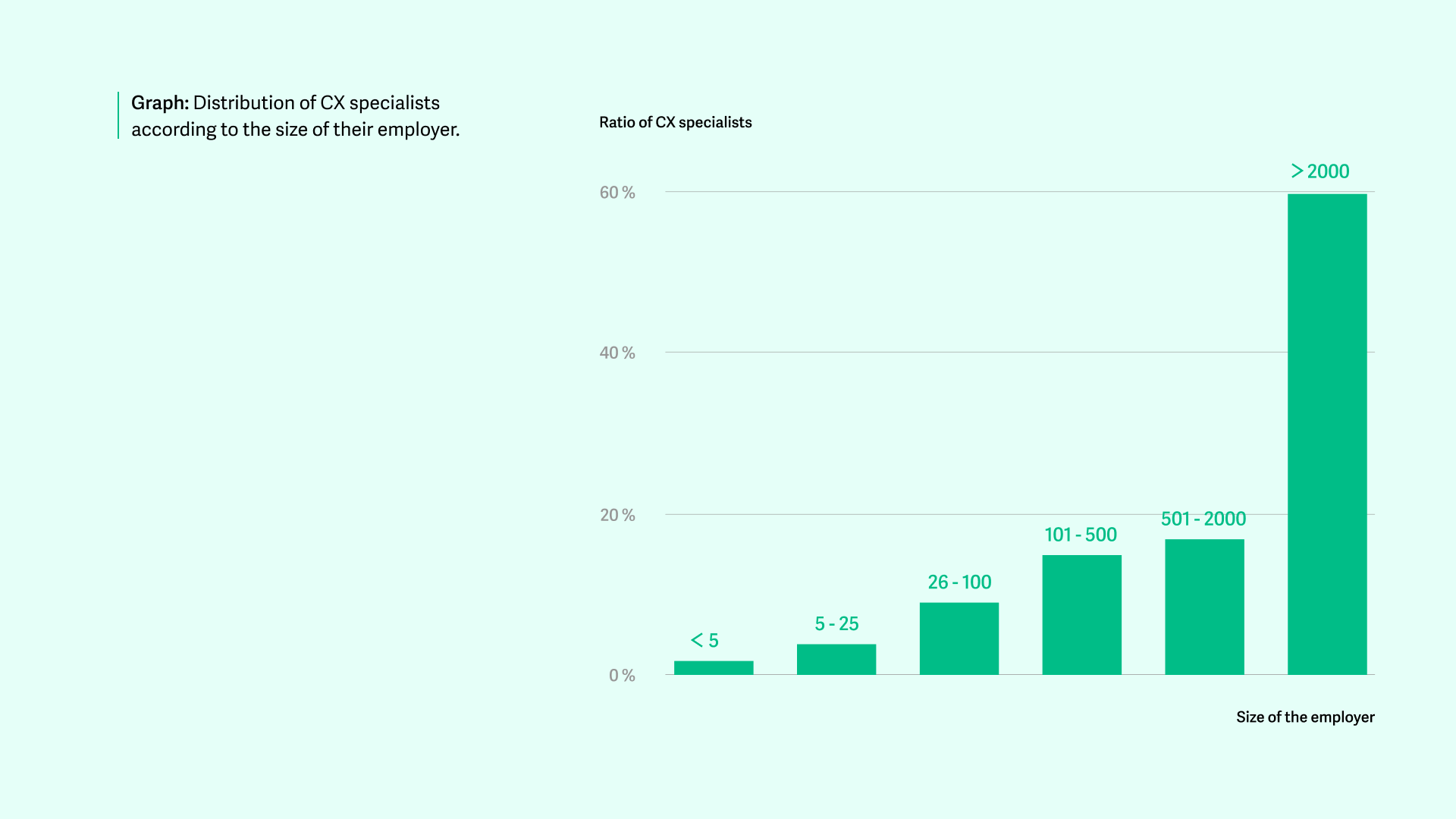

Now, let's look inside the companies. What's happening there? One of the things we comment on in the survey is that recruitment mainly took place in large companies.

Interestingly, the number of new CX specialists has increased, but when we look at the curve, almost 60% of all CX specialists in the market work for companies that employ 2000+ employees. The median number of CX specialists per company has increased from two to three. How do you perceive it?

On one hand, I perceive it internally, through LB*. Until 2021, we had a problem with recruiting new people, and mostly we hired a junior who needed to learn and had to be trained. Now we don't have that much difficulty hiring someone who is experienced and already has some background.

The same is evident in organizations. Now, when you meet someone, you will always find someone responsible for CX in that organization. Especially in larger companies with 500+ employees. There's someone who deals with Customer Experience, and it's not someone from the call center. These are people who mention terms like customer journey, testing, interviews, or research.

When we measure the goals of organizations, we can see that last year, their goal was to recruit people. Nowadays, they are no longer hiring that much, and probably it will remain that way.

In the context of the times, yes, because now budgets are getting limited, and stakeholders have already been hired. Now they need to turn that into results. When they want to move from Emergent to Structured level, or even higher, towards Integrated, there's simply nothing else left but to focus on results. Stop hiring that much and rather utilize the existing workforce and structure it.

It's good that we also monitor the goals for the next year in the survey. The number of companies that want to focus either on innovation or on results next year has increased significantly. It's as if they want to defend the recruitment that took place last year.

Or they want to defend that now they have more expertise. Those individuals have grown and have higher ambitions. When we discussed this, two hypotheses were made. One is the purpose of hiring people. The other is that budgets are decreasing or not increasing as they used to, so they are afraid of losing positions that cease being popular.

We measured that we are at level 3.5. This means we are somewhere between Emergent and Structured level companies. Last year, teams expanded, and they hired people. What's happening in those companies now?

They are building partnerships with other departments. They are trying to strengthen the factors of awareness and embedding. They are trying to harmonize. As the teams have grown, they need to get used to working with CX, not only in terms of collaboration but also in terms of when and what methodologies to use.

It's primarily about partnerships and the first wins, where they can show value. We have grown, let's show that taking care of customers and their needs makes sense. But for that, we need partners from within the organization.

What are the most significant barriers that organizations must overcome? What currently troubles them the most?

Often, the barrier is that people in teams have a strong desire to change things very quickly, but the organization doesn't change that fast, and they have a problem understanding it and being patient.

Just because they are convinced that it has value, doesn't mean that people from other departments are equally convinced. So it's not about how to do a design sprint, but rather how to show people that a design sprint makes sense in the first place.

Another barrier is the established processes, for example, the procurement process. When someone wants to quickly buy a tool, such as Figma, it takes a very long time, or it may not even be possible because they already have an established tool.

New things or products require a lot of analysis, functional specifications, and feasibility studies, which is not always compatible with the fact that I am going to the customer and I quickly need to create a prototype. When I have a prototype, I can get to production faster. It's a common barrier.

The survey also shows that up to one-half of the organizations run projects whose main goal is to improve the Customer Experience. So these projects are really happening. For example, companies have been doing service design for a long time; they have been improving customer journeys for a long time, but often, the value from that comes out only after years of collaboration.

It's a long process. As the survey shows, we are on average at level 3.5. Organizations are approaching the most challenging level, which is Structured CX. At the Structured level, it's very easy to say, "It's already working for us. We know how to do these activities; we involve the customer, and we have partners."

And often, they either get stuck because they can deliver a product, but they don't start seeking value. That means they start experimenting and measuring it.

From all of this, I have the impression that we have reached a level where there might be a bit of regression. Teams will have to defend their positions, and it's questionable whether they can handle it, and whether they will be able to bring value. Do you think teams will be downsized?

I'm curious about the results next year, but I don't think it will happen this year. Building teams and refocusing the organization, required a lot of energy from individuals and management. Therefore, at the stage where they need to prove results, they don't disrupt the structure.

It was an investment companies had to make.

Exactly, it was an investment, and now they need to find out whether it made sense or not. This will take a while to be confirmed and I believe organizations are aware of it. But it's hard to say what will happen with the budget. Most of the teams we collaborate with have already received smaller budgets, especially for external suppliers like us.

In this case, they're expected to produce things internally. And that brings us back to what I mentioned earlier. Will they have the opportunity to experiment and thus build a foundation for measuring results? Because teams often need external stimuli for that.

Moreover, one-third of companies say they still don't have a budget for their activities, and 60% say the budget either doesn't exist, is small, or is very challenging to obtain. Organizations are already operating with a limited CX budget that will further shrink. They need to invest in education and development, so this year could become quite challenging.

To summarize, there is a lot of data, but in my opinion, one of the most significant findings is that we have indeed moved forward, and companies need to focus on results and deliver value this year.

What are the most critical aspects that companies should focus on in the field of Customer Experience development next year, or rather, this year? What will help them move to a higher level and defend their value within the company?

First and foremost, it's about getting out of multitasking. Get rid of the belief that they are available for everyone to deliver CX. How to move the design process smoothly within organizations? The transition from multitasking to distribution.

What we often observe is that one builds a strong CX team, and then everyone starts reaching out to them.

They become internal suppliers, but as a result, they are blocked in their growth because they no longer have the capacity to scale the Customer Experience and reach the level of User-driven CX. So the key is not to be multitaskers, not to be available for everyone, but also not to say no. Rather, it's about distributing responsibilities and building CX specialization within various teams.

It's no longer solely about the partnerships, we mentioned, but also about competence. Of course, partnerships remain essential. And when we talk about results, those results must be visible in other departments, not just within the CX.

It's not only about designing and delivering a new service, but also about how it contributes to other departments and other company metrics. The partnership is essential. Don't multitask, focus more on distribution and building the company's competence across the board.

This is where the term DesignOps comes in. Teams transform from being just competency centers that handle internal delivery and support the entire process.

That is the ideal time when a company feels it can reach the Structured level of CX. They see the need for someone to manage the design system, the processes, provide methodologies, maintain a database of research findings, and so on. So, it's a good step toward saying that they want to become Structured. That's when they need to start building a central unit that takes care of the design. It doesn't create it directly but supports its creation within the teams.

And one last thing, don't fall in love with the process, thinking that you already know how to do design and that's enough because you're tired. You need to go further. Level 4 is truly the most challenging. It's about finding value and proving that the structure and new processes are beneficial for the company. The center of these new processes is the customer. It's their needs that are being monitored. This can be very beneficial for future business goals.

So, don't rest on your laurels, and don't forget about individuals and their need for education, growth, and experimentation. To reach the Integrated CX, Level 5, we need more than just experimenting, trying new things, changing, and supporting new approaches.

Great! Thank you very much. I would just like to add that you can download the results of the CX survey in Slovak on our website. There is a PDF document available with all the additional information and data.

The full interview with Juraj Blichár in Slovak language:

Minimum Viable Podcast is brought to you every two months by the design studio Lighting Beetle*, which focuses on creating an exceptional customer experience.

Design is all around us. Minimum Viable Podcast explores design with a small “d” – the one that looks for solutions to people's problems. In it, together with our guests, we address topics that are related to design, but we normally do not associate with it. Thanks to the Zeldeo production studio and our production manager Mojmír Procházka for the cooperation.

We are looking forward to every listen, follow, share, and suggestion for improvement. You can send us your tips for interesting personalities with whom we can talk about design to podcast@lbstudio.sk.